DS-2076 2006-2024 free printable template

Show details

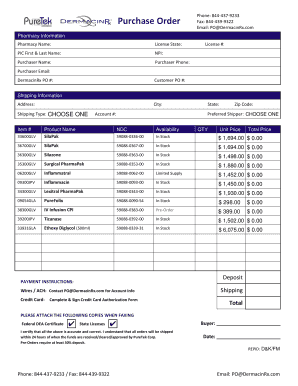

DS-2076. 02-2006. U.S. Department of State. PURCHASE ORDER, RECEIVING REPORT AND VOUCHER. Date. Purchaser: The United States Government, ...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ds 2076 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ds 2076 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ds 2076 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ds2076 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out ds 2076 form

How to fill out form 2076 form:

01

Begin by carefully reading the instructions provided on the form to ensure you understand the requirements.

02

Fill in your personal information accurately, including your name, address, and contact details.

03

Provide any necessary identification numbers or codes, such as your social security number or taxpayer identification number.

04

Complete the sections related to your income, deductions, and credits according to the instructions.

05

Double-check all the entered information for accuracy and legibility before submitting the form.

Who needs form 2076 form:

01

Individuals who have specific income, deductions, or credits that are required to be reported using this form.

02

Taxpayers who have received specific types of income such as certain types of interest, royalties, or dividends.

03

Individuals claiming certain deductions or credits that are only eligible through the use of this form.

Fill ds2076 fillable : Try Risk Free

People Also Ask about ds 2076

What is the Medical Privacy Act in Texas?

How far back do medical records go Texas?

How long does it take to get medical records in Texas?

What is an authorization for release of information?

How do I get my medical records in Texas?

How much does it cost to get medical records in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out form 2076 form?

1. Enter your information at the top of the form, including your full name, address, and Social Security Number.

2. Enter the date you completed the form in the “Date” box.

3. Enter the employer’s name and address in the “Employer’s Name and Address” box.

4. Enter the employer’s Federal Employer Identification Number (FEIN) in the “FEIN” box.

5. Enter the dates of your employment with the employer in the “From” and “To” boxes.

6. Enter a description of the services you provided for the employer in the “Description of Service” box.

7. Enter the amount of money you earned from the employer in the “Amount of Earnings” box.

8. Enter the amount of withholding taxes the employer withheld on your behalf in the “Amount of Withholding” box.

9. Sign and date the form in the “Signature” and “Date” boxes.

10. Mail the form to the address listed on the form.

What is the purpose of form 2076 form?

Form 2076 is an IRS form used to report the sale or exchange of a capital asset. It is used to report the sale of stocks, bonds, mutual funds, real estate, and other similar capital assets. The information from this form is used to calculate capital gains and losses for tax purposes.

What information must be reported on form 2076 form?

Form 2076 is used to report information pertaining to real property sales, exchanges, or dispositions. The following information must be reported on Form 2076:

1. Name, address, and tax identification number of each person involved in the transaction.

2. Description of each real property involved in the transaction.

3. Date of the transaction.

4. Purchase price, including any exchange value, of the real property.

5. Any liabilities assumed by the buyer.

6. Any liabilities assumed by the seller.

7. Any cash or other consideration paid or received.

8. Gain or loss from the transaction.

9. Any information regarding any applicable installment sales.

10. Any information regarding any applicable depreciation recapture.

When is the deadline to file form 2076 form in 2023?

The deadline to file Form 2076 for the 2023 tax year is April 15, 2024.

What is form 2076 form?

There does not appear to be a specific form with the designation "Form 2076." It is possible that you may be referring to a form used in a specific country or organization that is not widely recognized or known. It would be helpful to provide more context or details about the specific purpose or jurisdiction of the form in question.

Who is required to file form 2076 form?

Form 2076 is not a commonly used form and does not exist in the IRS forms library. It is possible that you may be referring to a form used by a specific organization or state government. Without more information about the specific context or purpose of the form, it is difficult to determine who would be required to file it.

What is the penalty for the late filing of form 2076 form?

Form 2076 refers to the Annual Return of Withheld Federal Income Tax, which is typically filed by the employer. The penalty for late filing of this form may vary depending on the jurisdiction and the specific circumstances. It is recommended to consult with a tax professional or refer to the relevant tax authority's guidelines to determine the exact penalties and consequences for late filing of Form 2076.

Can I sign the ds 2076 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ds2076 form.

How do I edit form 2076 form straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing form ds 2076, you can start right away.

Can I edit ds 2076 form on an Android device?

You can edit, sign, and distribute voucher 2076 form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your ds 2076 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 2076 Form is not the form you're looking for?Search for another form here.

Keywords relevant to state ds 2076 form

Related to form 2076 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.